Banking products online

Create and launch a complete online sales process for banking products - from the presentation of the offer, through accepting applications, to the finalisation of the contract

Our solution

Sell any banking products online with easy-to-use tools

You can use the sales path templates developed by the Cloud Services team or create your own processes - fully customized for sales offers of loans, bank accounts, credit cards, deposits or investment products.

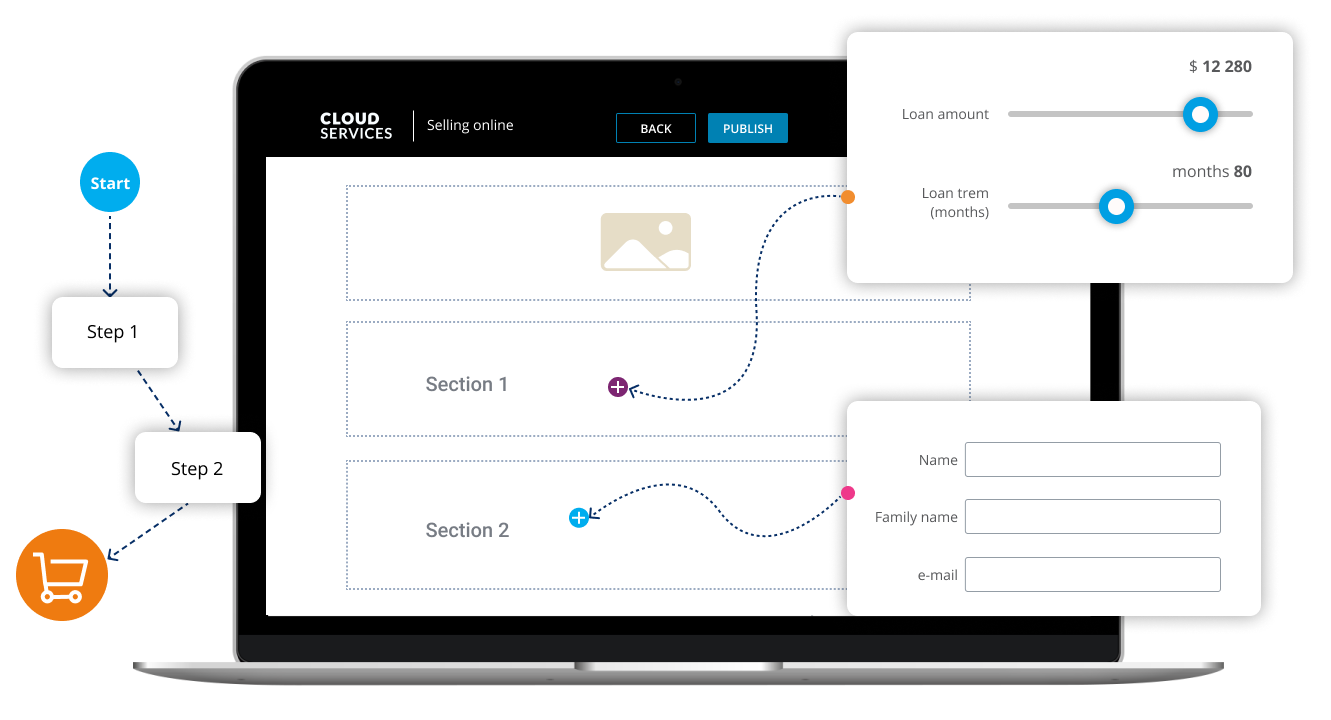

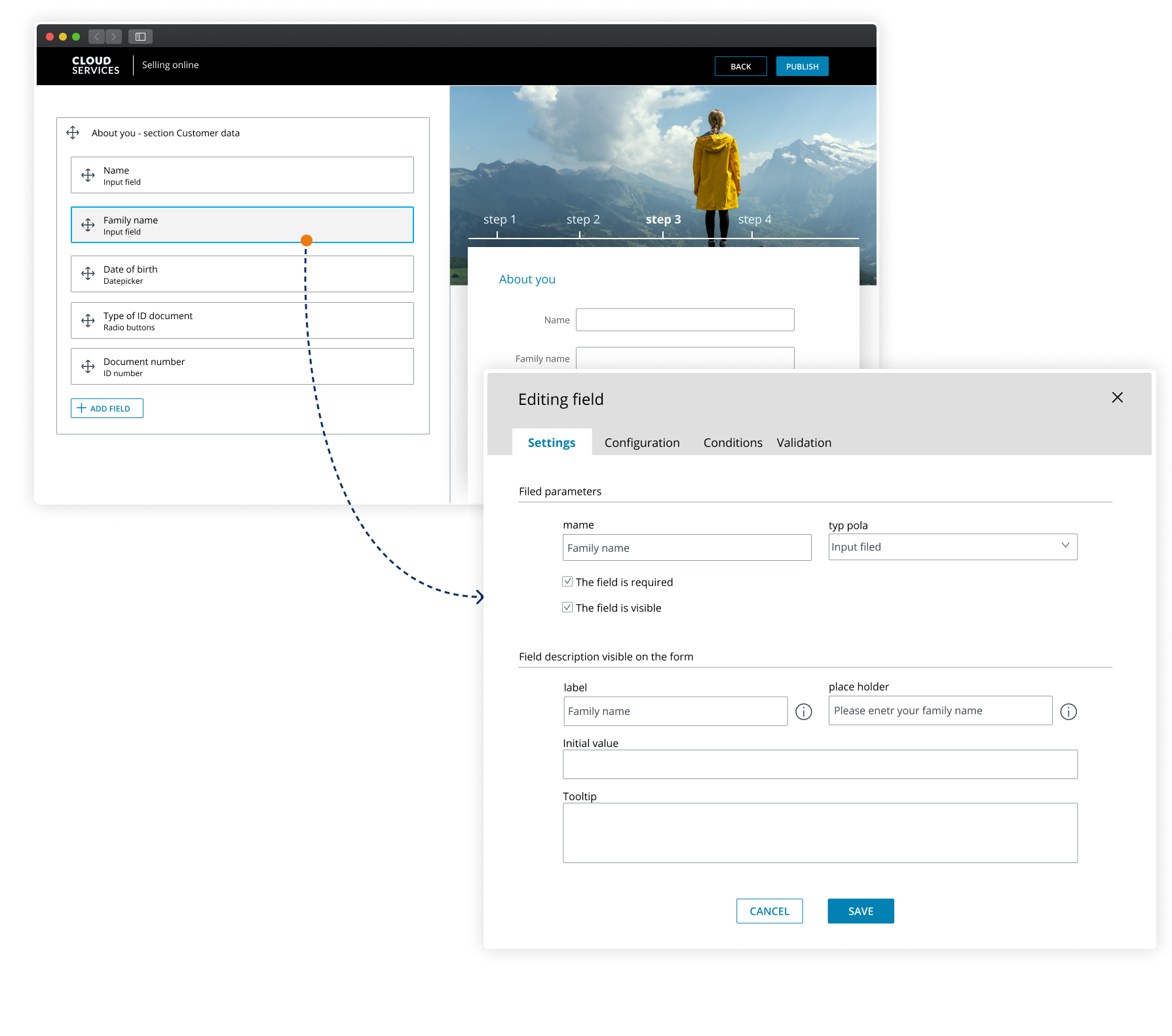

Sales paths can be built with the help of an intuitive wizard, which has been designed so that its operation does not require any technical preparation or involvement of additional IT specialists.

The tool has added ready-made elements from which you can build multi-step forms. Each form can contain a different number and type of fields.

Using the Cloud Services wizard is simple and intuitive

No technical knowledge and programming support is required.

This allows each member of your team to create the necessary sales processes themselves at any time. The system generates forms, the appearance of which fully corresponds to the visual identity of your website, so that customers feel that they are an integral part of it.

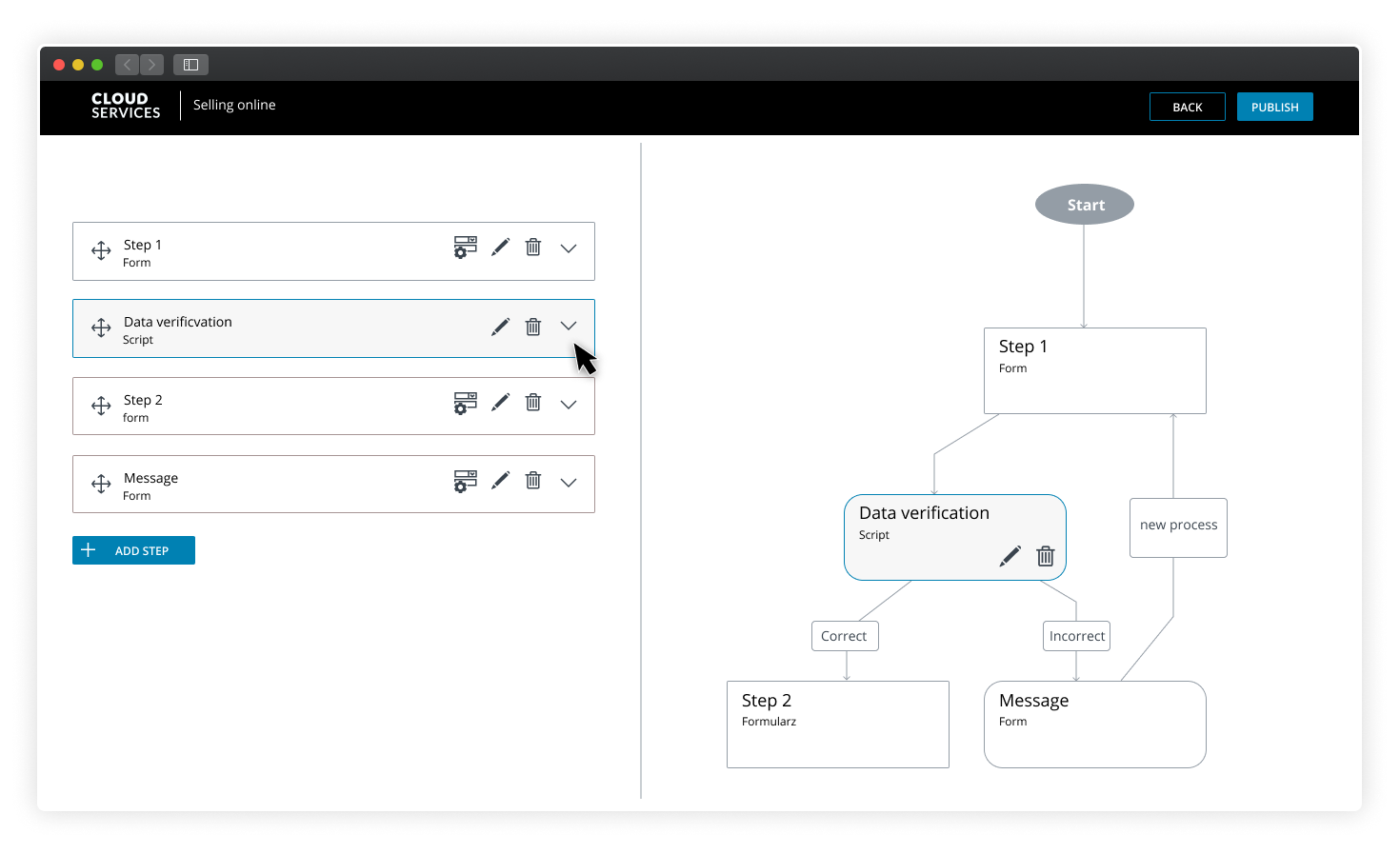

Enable advanced mechanisms and create complex user paths

Thanks to the so-called 'functional steps' you can also enrich the process with such elements as:

- logical gates (alternative paths),

- sending messages (SMS/e-mail/telephone),

- ready integration with external services - such as CEIDG/GUS/RDO/PESEL databases and others,

- dedicated integrations with external services using the REST API/SOAP wizard.

Thanks to the simple construction of the wizard and intuitive use of individual components, each person from your sales and marketing team can create forms tailored to the nature of products they currently want to sell. With a few clicks, they can change the order and type of fields and ways to move from one view to another

Accelerate the processing of credit applications, thanks to the automatic evaluation of the prospects' creditworthiness

Activate a mechanism that will independently verify the creditworthiness of the potential customer.

The system analyzes data entered by customers into the form, such as: monthly income, expenses, fixed charges, and on this basis determines whether a person can use a given banking product.

The mechanism can be implemented in two ways: through integration with your bank's scoring system or implementation of a creditworthiness matrix.

The system can also be integrated with the bank's databases, external applications processing, organizing and providing data from e.g. a customer's bank statement.

Use the automatic contract generator and remote signature mechanisms to quickly close the online sales process.

With these two tools, you can significantly speed up the sales process, make your offer more attractive, and sell effectively 100% remotely.

The generator allows you to create personalized documents, which are necessary to finalize the purchase of a bank product. In one place you can generate a contract and all necessary attachments. Thanks to our mechanisms, you can conclude contracts fully remotely, making sure that customer data and details of the contract itself are properly secured. We make it possible: confirmation of the customer's identity on the basis of documents, as the system is integrated with the gov databases; integration with the Blue Media Identification service, which is a set of authorization methods such as verification transfer, electronic signature and PSD2 services and integration with external services.

Collect valuable leads through customer prevalidation mechanisms

Activate the anti-fraud system for customer prevalidation, which will allow you to assess risk based on the rules you have defined.

The credibility of a potential customer is extremely important, especially when selling banking products. That is why we have created a modern system that enables verification of contact data and confirmation of prospectus identity. The system can check the compliance of the entered name with the gender - based on the PESEL identification number. The anti-fraud verification can also be extended to include libraries of suspicious domains and identification data of customers who have had problems with repayment of liabilities, including loans in the past. The solution also enables verification of the authenticity of the e-mail address and telephone number by sending a message through an appropriate channel and making the transition to the next step in the form a positive verification. It may boil down to the fact that the client has to click on the link visible in the e-mail or rewrite in the appropriate window the code received in the SMS to go to the next step in the process. Moreover, the solution allows to build rules based on a set of several dozen environmental data (such as user type, operating system, browser, etc.) and behavioral data (number of errors in particular fields, historical analysis of conclusions, associated on the basis of selected data, etc.).

Such a structured, fast and effective verification process allows to confirm the identity of the customer and the truthfulness of the contact data provided by him in a few seconds.

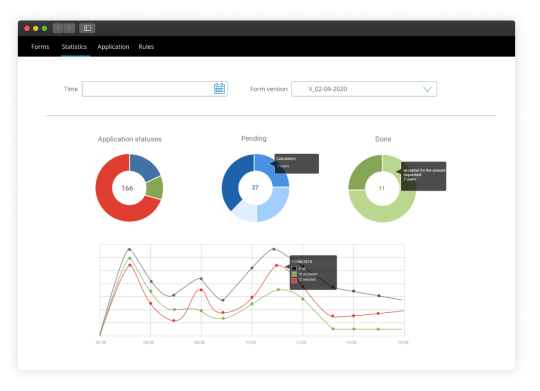

Have full control over your sales processes with comprehensive analytical tools

Analyze the behavior of potential customers on the purchasing path, optimize it based on big data, get better results and maximize profits.

Our system monitors user behavior in sales applications, processes the collected data and presents it in a clear and understandable form:number, stages and reasons for process abandonment; the number of rejections due to validation or anti-fraud mechanisms; list of accepted and rejected calculations. The collected data is presented in the form of charts, which makes it legible and easy to interpret. Based on reliable data you can react quickly and modify your sales path accordingly to increase its effectiveness. The system also allows you to generate reports summarizing the information obtained from the analysis.

Need even more? We also create dedicated solutions. Contact us and we will discuss your needs

We have almost unlimited possibilities when it comes to integration with external services. All thanks to an extensive integration configurator (REST API), which has the necessary integration mechanisms built in.

Apart from technological resources, we also have a team of specialists with many years of experience in the financial industry, who are able to create a solution fully tailored to the needs of this market.

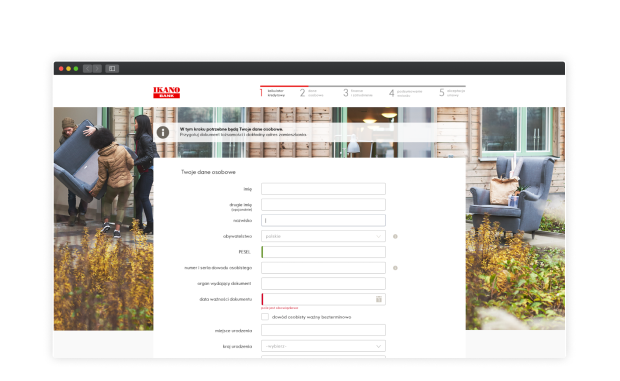

Learn the solution in practice

Implementation of an online credit process for Ikano Bank, branch in Poland.

more >Contact us

Learn more about our solutions

Self-service online

Reduce the number of inquiries to support center and reduce the cost of handling interested parties by providing your customers with easy-to-use tools to change account details, submit applications and complaints themselves.

more >Portal online

Design, create and launch a fully functional website - without the need to involve IT specialists. Use ready-made tools and run any number of websites tailored to your business needs.

more >VAS Solutions

Increase revenue from your online channel with sales solutions that can be implemented in any industry. You can already easily deploy a system to sell tickets, insurance, banking products, and more.

more >